Credit card companies play a crucial part in the modern – day financial ecosystem. One of the less – known but equally important aspects of their operations is their role in identifying fake ID cards. This is not only vital for protecting their own financial interests but also for upholding the integrity of the overall consumer environment.

Understanding the Need for Identifying Fake ID Cards

Fake ID cards are a significant concern in many industries, especially those related to age – restricted products and services. Credit card companies are at risk when fraudsters use fake IDs to obtain credit cards fraudulently. When a fake ID is used to open a credit card account, it can lead to a host of problems. The fraudster may then go on a spending spree, leaving the legitimate card issuer with significant losses when the debt goes unpaid. Moreover, it can damage the reputation of the credit card company if word gets out that they have issued cards to individuals with fake identities.

Another aspect is related to underage individuals attempting to use fake IDs to obtain credit cards. Since credit cards are typically only issued to adults, the use of fake IDs by minors is illegal and a violation of credit – issuing regulations. By identifying fake ID cards, credit card companies help prevent underage credit – card usage, which can have long – term negative financial impacts on young people who may not fully understand the responsibilities associated with credit.

The Tools and Techniques Used by Credit Card Companies

Biometric Verification

Many credit card companies are increasingly turning to biometric verification methods as part of their ID – checking process. Fingerprint scanning, for example, is a reliable way to ensure that the person presenting an ID is the actual individual associated with it. Biometric data is unique to each person, making it extremely difficult to forge. When a customer applies for a credit card, the fingerprint on the ID can be compared to the fingerprint provided during the application process. If there is a mismatch, it could be an indication of a fake ID.

Document Authentication

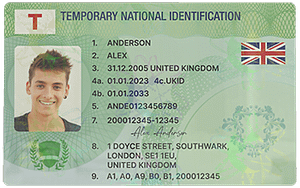

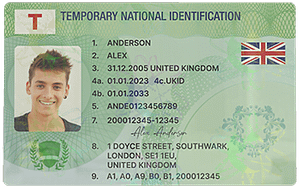

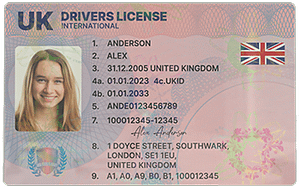

Credit card companies also have sophisticated document – authentication techniques. They can check for security features on ID cards such as holograms, watermarks, and microprinting. These features are often difficult to replicate accurately, and their absence or incorrect representation can be a red flag for a fake ID. For instance, a well – trained employee at a credit card company can use special lighting to examine an ID card for hidden watermarks or look for the proper alignment of holographic images.

Database Cross – Referencing

Credit card companies maintain extensive databases of customer information. When an application is received, they cross – reference the details on the ID card with other data sources. This may include checking with government databases to verify the authenticity of the ID number, name, and date of birth. If the information on the ID does not match what is in the official records, it is likely that the ID is fake. Additionally, they may compare the applicant’s information with their own internal records of previous applications and transactions to look for any discrepancies or patterns of fraud.

The Staff Training Aspect

Credit card company employees, especially those involved in the application – processing and customer – verification stages, undergo extensive training. They are taught how to spot the signs of a fake ID, from the physical appearance of the card to the behavior of the applicant. For example, they are trained to notice if an applicant seems overly nervous or evasive when questioned about their ID or personal information. They are also trained to recognize the typical signs of a poorly – made fake ID, such as low – quality printing, incorrect font usage, or misaligned text.

Regular training sessions are held to keep employees updated on the latest types of fake IDs and the methods used to create them. This helps them stay one step ahead of fraudsters who are constantly evolving their techniques. In addition, employees are trained on how to handle suspected fake ID cases in a professional and legal manner. They need to know the proper procedures for reporting the case to the relevant authorities and for dealing with the applicant in a way that minimizes any potential legal or reputational risks for the credit card company.

Collaboration with Law Enforcement

Credit card companies often collaborate closely with law enforcement agencies in the fight against fake ID cards. When a credit card company suspects that a fake ID has been used in an application or transaction, they may report it to the police or other relevant authorities. Law enforcement agencies have access to even more advanced forensic tools and databases that can be used to investigate the origin and distribution of fake IDs.

In return, law enforcement agencies may share information with credit card companies about emerging trends in fake ID production and usage. This collaborative approach helps both parties stay informed and take proactive measures to prevent fraud. For example, if law enforcement discovers a new batch of fake IDs being circulated in a particular area, they can notify credit card companies so that they can be extra vigilant when processing applications from that region.

Common Problems and Solutions

Problem 1: Advanced Forgery Techniques

Fraudsters are constantly developing more advanced forgery techniques. They may use high – quality printers and materials to create fake ID cards that are difficult to distinguish from genuine ones at first glance. The solution to this problem lies in continuous innovation on the part of credit card companies. They need to invest in more advanced authentication technologies, such as 3D holographic security features that are extremely difficult to replicate. Additionally, employees should be trained on how to spot the subtle differences in even the most sophisticated fake IDs.

Problem 2: Data Breaches

Data breaches can be a major problem for credit card companies. If fraudsters gain access to the company’s databases containing customer information, they can use this data to create more convincing fake IDs. To address this, credit card companies must implement strict data – security measures. This includes using encryption to protect customer data, conducting regular security audits, and having a comprehensive incident – response plan in place. In case of a data breach, they should be able to quickly notify affected customers and take steps to prevent any further misuse of the stolen data.

Problem 3: Employee Error

Despite training, employees may still make errors in identifying fake ID cards. This could be due to inattention, lack of experience, or being tricked by a particularly clever fraudster. To minimize this risk, credit card companies should have a system of double – checks and quality control. For example, applications with suspected fake IDs can be reviewed by a second, more experienced employee. Additionally, regular performance evaluations and refresher training can help ensure that employees are maintaining a high level of accuracy in their ID – checking processes.

Problem 4: Changing Regulations

Regulations regarding ID verification and credit – card issuance can change over time. Credit card companies need to stay updated on these changes to ensure that their ID – checking processes are compliant. The solution is to have a dedicated regulatory – compliance team that monitors changes in laws and regulations. This team can then communicate any necessary changes to the rest of the organization and ensure that all employees are trained on the new requirements.

Problem 5: International Fake ID Challenges

With the globalization of the economy, credit card companies may face challenges in dealing with fake ID cards from different countries. Each country may have different ID – issuing standards and security features. To overcome this, credit card companies can build international partnerships and share information with other financial institutions and regulatory bodies around the world. They can also invest in research to understand the common types of fake IDs from different regions and develop appropriate verification methods.